Introduction

Paymint is a centralized platform designed to help individuals manage their finances effectively and work towards achieving their financial goals. It provides users with a comprehensive set of tools and features to track income and expenses, create budgets, analyze spending patterns, set financial goals, manage debt, and generate reports. By offering these functionalities, Paymint aims to promote financial literacy, responsible money management, and improved financial well-being for its users.

Objectives

The objective of Paymint is to provide users with a comprehensive toolset to effectively manage their personal finances. The application aims to achieve the following objectives:

- Enable users to create and manage budgets, track expenses, and categorize income and expenses.

- Facilitate the integration of users’ bank accounts and credit cards to automatically import transactions.

- Offer insights and suggestions to improve users’ financial health, identify areas for expense reduction, and increase savings.

- Enable users to set financial goals, track progress, and provide tools for managing debt.

- Provide users with the ability to generate reports and visualizations of their financial data.

Features

The following features are available in the Paymint – Personal Finance Manager system:

-

Budget Management

- Allow users to create and manage budgets.

- Track and categorize expenses against budget categories.

- Provide budgeting tools to set limits and monitor progress.

-

Transaction Tracking

- Enable users to view and categorize their transactions.

- Import transactions automatically from linked bank accounts and credit cards.

-

Financial Insights

- Offer insights and suggestions to improve financial health.

- Identify areas for expense reduction and savings.

-

Goal Setting and Tracking

- Allow users to set financial goals.

- Track progress towards achieving goals.

- Provide tools for managing debt and generating payoff plans.

-

Reporting and Visualization

- Generate financial reports and visualizations based on user data.

- Provide intuitive charts and graphs for better understanding of financial patterns.

-

Debt Management

- Include features for managing and tracking debts.

- Allow users to input and track their outstanding debts, such as loans and credit card balances.

- Provide tools for creating debt payoff plans and strategies.

Technology Stack

Paymint – Personal Finance Manager utilizes the following technologies:

- Frontend: React.js, Redux.js

- Backend: Spring Boot

- Security: Spring Security

- Database: MySQL

System Architecture

The system architecture of Paymint – Personal Finance Manager consists of several components, including the frontend user interface, backend server, and database. The frontend is built using modern web technologies such as React.js and Redux.js, and it interacts with the backend server implemented using Spring Boot through RESTful APIs. Spring Security ensures secure user authentication and authorization.

The database design includes tables for users, accounts, transactions, goals, budgets, debts, and categories. These tables store the relevant data to enable seamless user interactions and data analysis.

Installation and Usage

To use Paymint – Personal Finance Manager, follow these steps:

- Clone the repository to your local machine.

- Install the necessary dependencies for both frontend and backend.

- Set up the database and configure the connection in the backend server.

- Run the backend server and frontend application.

- Access the application through your web browser.

Make sure to provide proper configuration for security and sensitive information, such as API Endpoint and database credentials.

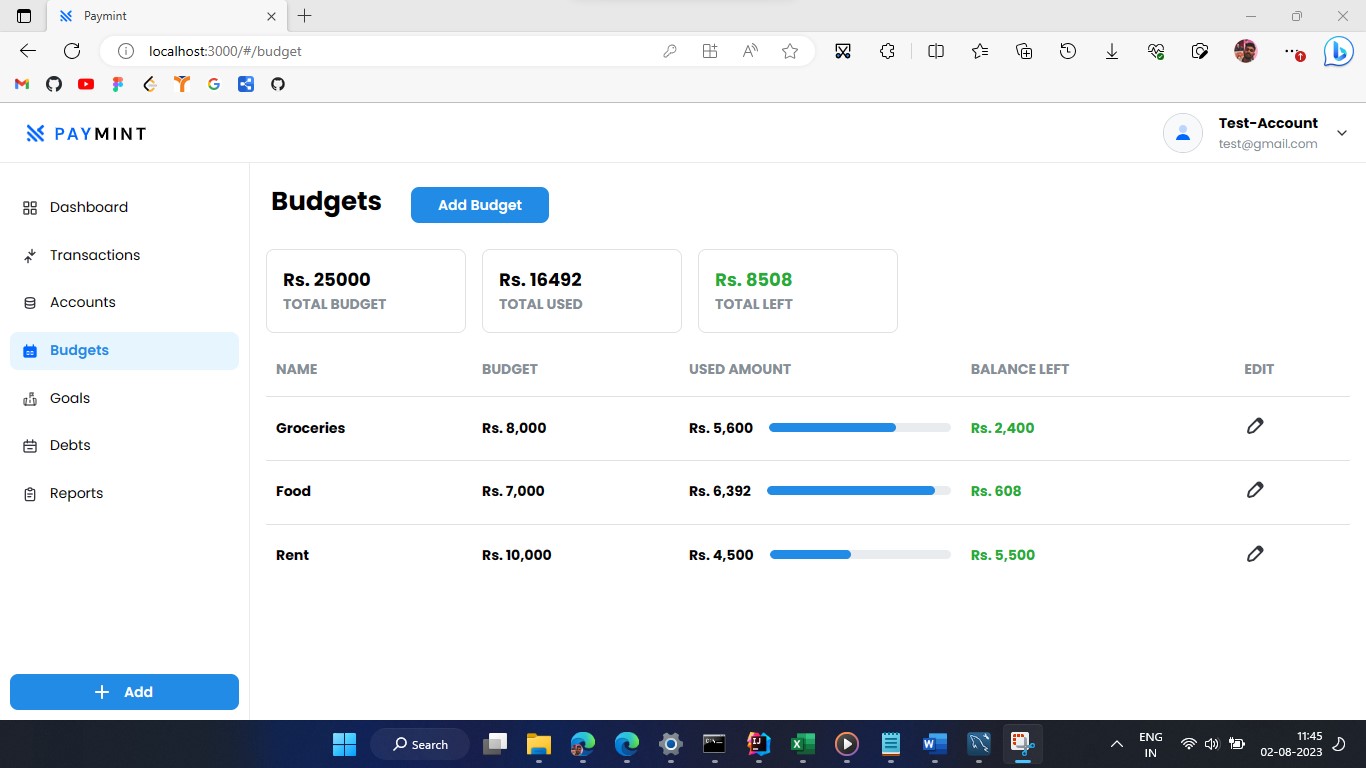

Screenshots

Here are some screenshots of the application’s user interface:

- Landing Page

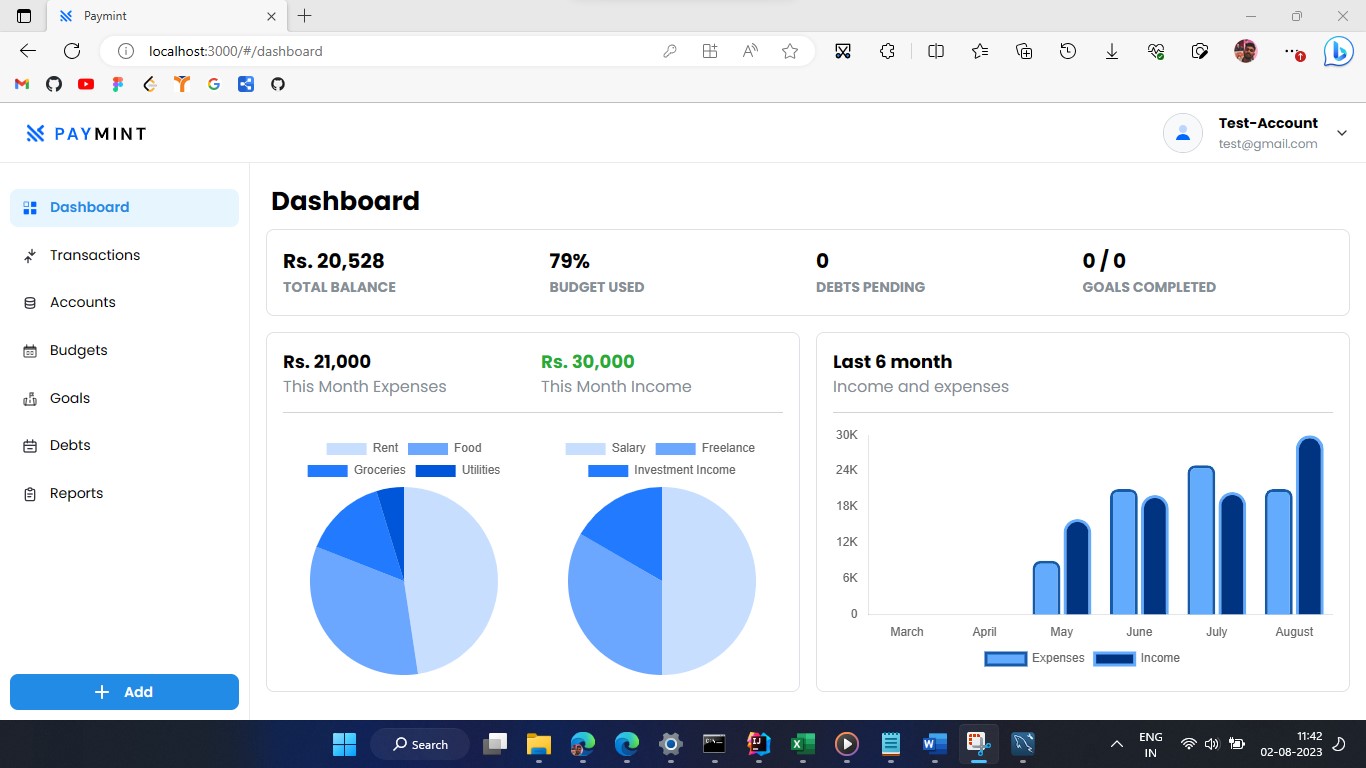

- Dashboard Page

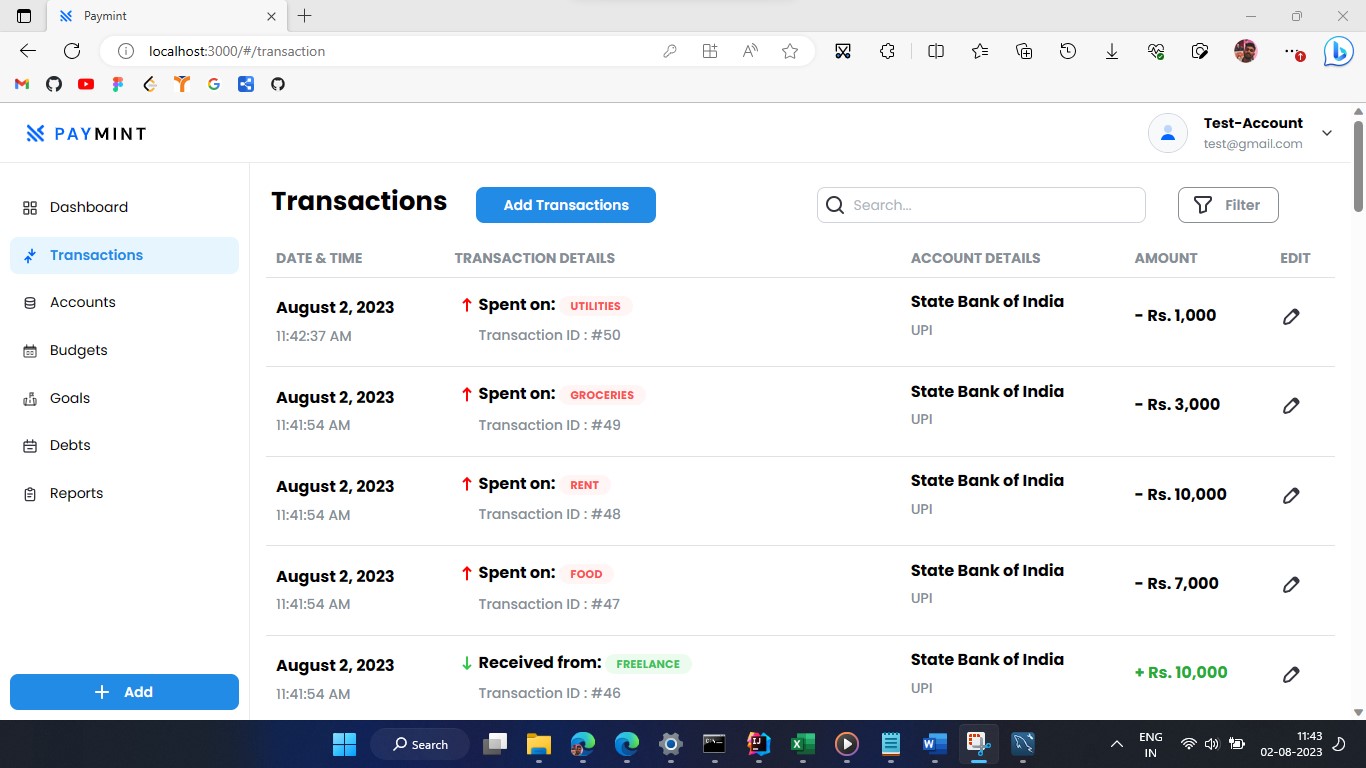

- Transaction Page

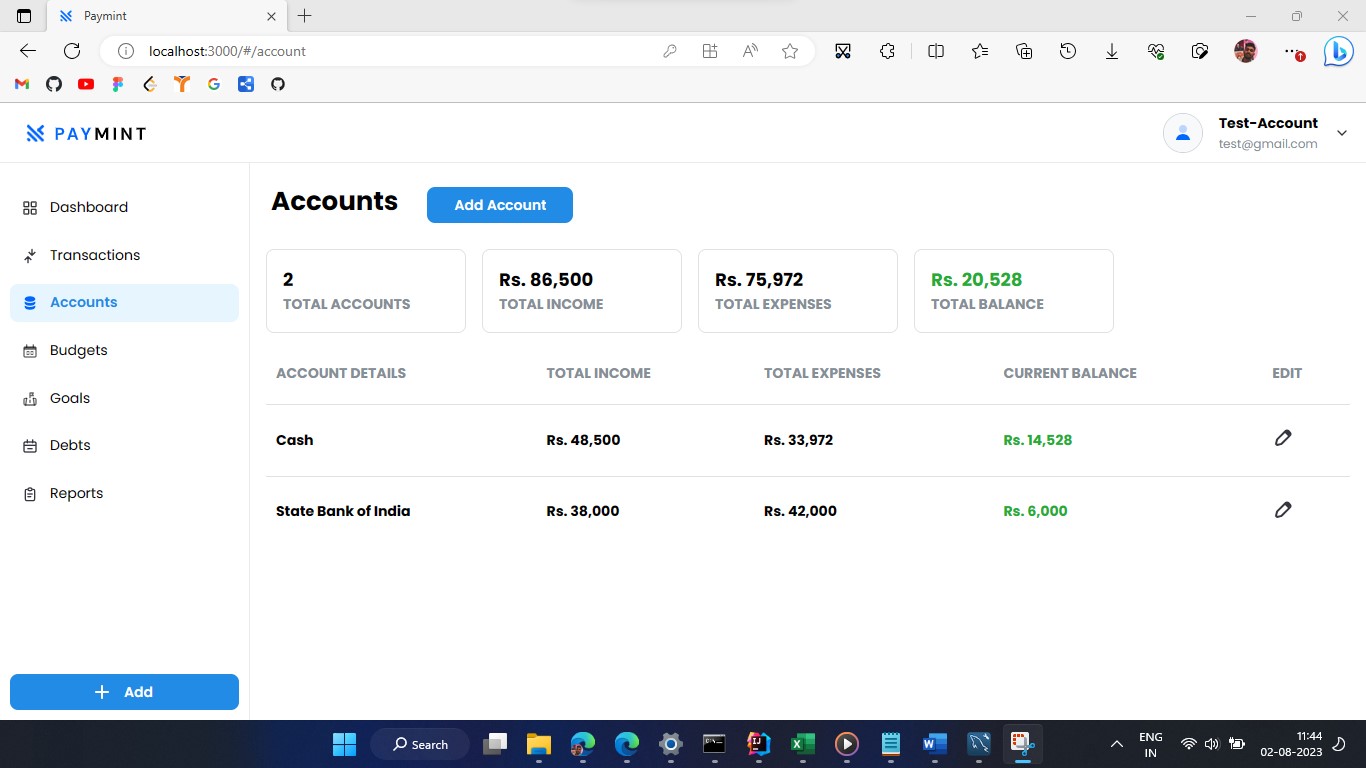

- Accounts Page

- Budgets Page

Conclusion

Paymint – Personal Finance Manager provides a user-friendly platform for managing personal finances effectively. With features like budget management, transaction tracking, goal setting, and debt management, users can gain better control over their financial health and work towards achieving their financial goals. The application’s reporting and visualization capabilities offer valuable insights to make informed financial decisions.

Feel free to contribute, report issues, or provide feedback to enhance the functionality and user experience of Paymint – Personal Finance Manager. Happy managing your finances!